PARTICIPATION

Active Participants

You become an "active" participant in the Pension Fund at the end of the Plan Year (January 1 - December 31) in which you work in Covered Employment for 800 hours or more. Once you meet the initial eligibility requirement, your eligibility will continue as long as you remain an Eligible Employee and obtain at least 200 hours in each Plan Year.

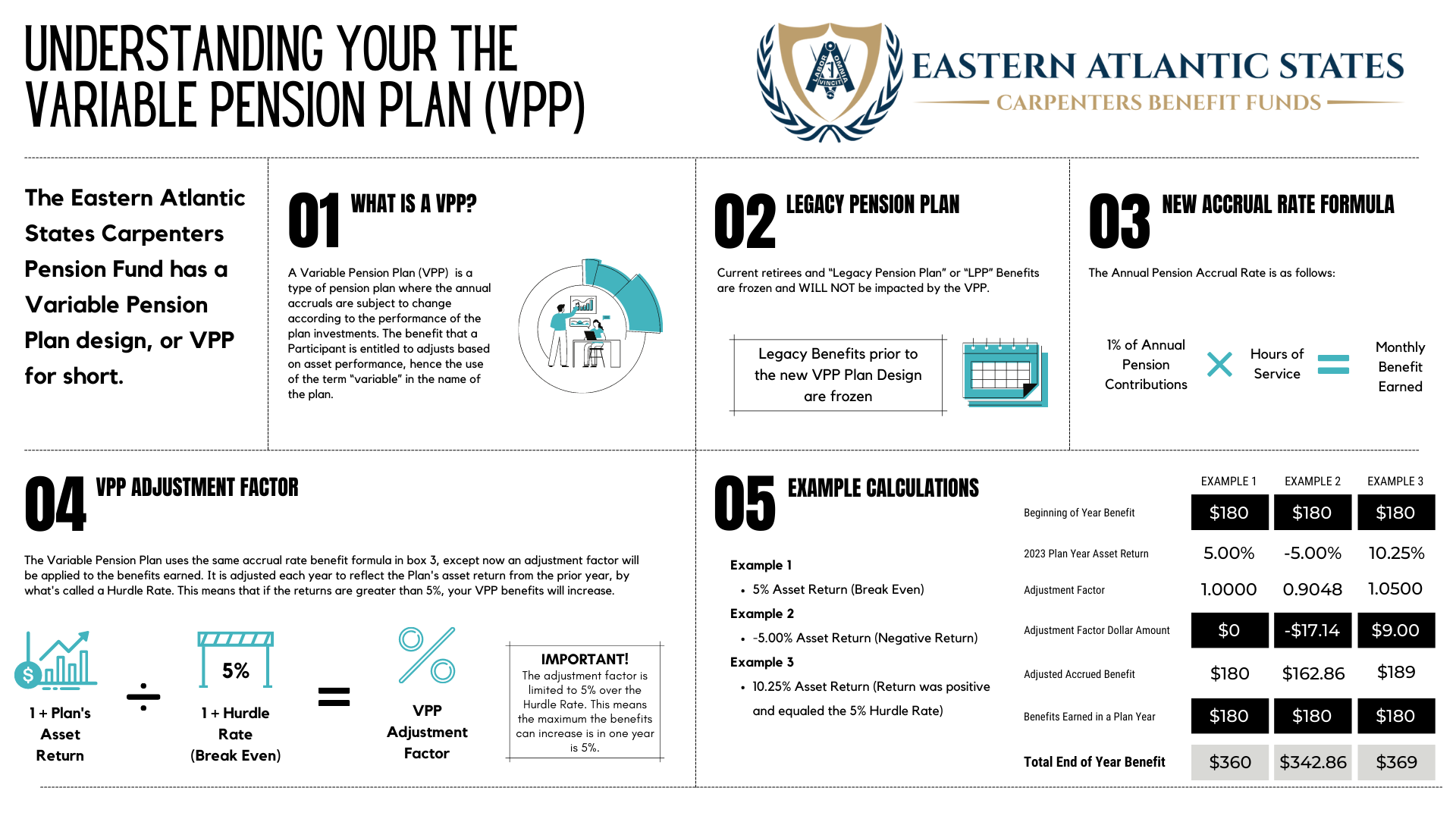

EAS VARIABLE PENSION PLAN (VPP)

Pension Plan Year (January 1st - December 31st)

A Variable Pension Plan (VPP) is a type of pension plan where the annual accruals, both while working and in retirement, are subject to change according to the performance of the Plan's investments.

1% x benefit-bearing contributions made

For example, $20,000 in annual employer Pension contributions = $200 Accrual ($20,000 x 1% = $200)

The benefit is adjusted each year based on the Pension Plan's investment returns.

*Please note that not all Collective Bargaining Agreements have the same rates. This example for illustration purposes only.

Adjustments made at end of plan year based on prior year returns (1-year lag)

Hurdle Rate is five percent (5.0%). This means that if the Fund's Investment returns are greater than 5%, your VPP benefits will increase.

5% (Benefit will not increase more than 5% in one year)

Eastern Atlantic States Pension Plan Year runs January 1st - December 31st

- Current Vested Participants will automatically be vested in the new Pension Plan and previous Credited Service will be carried over.

- Non-Vested Philadelphia Participants with one hour of service pre-merger will be grandfathered under the current 3-year Vesting Service Rule.

- If you had Credited Service in both New Jersey and Philadelphia Funds, they will be combined.

- New Participants on or after January 1, 2023 will be subject to 5-year vesting.

- Hours on or after the merger date will be credited as follows:

|

200-399 hours |

¼ year Vesting Service |

|

400-599 hours |

½ year Vesting Service |

|

600-799 hours |

¾ year Vesting Service |

|

800+ hours |

1 year Vesting Service |

When Can I Retire?

Normal Retirement Eligibility:

- Age 65 with 5 years of Credited Service

Early Retirement Eligibility:

- Age 55 with 10 years of Credited Service

Former Philadelphia Participants with 1-hour pre-merger are eligible to retire if they meet pre-merger early retirement rules (i.e. 52/33, 53/32, or 54/31)

Additional Plan Changes:

Disability Retirement Benefits:

- SSA disability award

- 10+ years of Credited Service

- Ceases to be an Active Participant because of disability

- Onset while Active and during a period of 10 or more Consecutive Years of Service

- Furnish all information the Board requires

- Subject to 3% age reduction factor if less than 20 years of service (21% cap)

- See Retirement Benefits and Qualifications

Unreduced Joint and Survivor Option:

- Participants retiring on or after age 65 may be eligible for an unreduced Joint and 100% Survivor form of benefit. See Types of Monthly Retirement Options

Post-Retirement Death Benefit:

- A minimum post-retirement death benefit of $10,000 is payable with respect to Normal, Early and Disabled Retirees.

- If the post-retirement death benefit accrued through the date of the merger is greater than $10,000, the higher amount will be payable. See Pension Plan Death Benefits